Contents

- 1 What hides behind the three letters

- 2 The goals of the ICO projects, that we worked with

- 3 How we got prepared for running an ad campaign

- 4 Here’s the ICO advertising model, that we offer

- 5 Our ad campaigns strategy

- 6 How we managed ad creatives

- 7 How we tracked the performance

- 8 How we came across a unique obstacle

- 9 Our results and indicators

- 10 Why our strategy worked, and what you better not miss

ICO is a rather young way of investing. It owes its popularity to the sudden growth of the cryptocurrency market. The wave of ICO projects has risen at one moment, and so has the need for their promotion. Global goals in the shortest time possible formed the demand for the specialists, capable of taking on such work.

The Median ads team is always looking for complex projects to get on the new level of expertise. We got into the ICO niche, as we moved to large budgets. Spending such budgets requires a deep analysis with a swift adaptation along the way.

In this article, we’ll share the key aspects of our model for the ICO projects promotion. Let’s all get into it, step by step.

What hides behind the three letters

The term “Initial Coin Offering” is made of “Initial Public Offering”. In both cases, we’re talking about companies selling valuable assets. In cryptocurrency projects, these assets are the tokens.

What is the key difference between ICO and IPO?

IPO is only possible for the companies, who have their heavy financial pillars and sufficient publicity. ICO, on the other hand, is used to collect seed capital. That is due to the fact, that cryptocurrencies entered the market swiftly, and the businesses didn’t have enough time to strengthen their positions.

The ICO process starts with an announcement of a project and a presentation of its whitepaper. Next follows the pre-sale period and the main token sale. In the end, a tech company receives investments for its growth, and investors get their income.

Each company sets its conditions for selling tokens in its whitepaper, so the business strategy is always individual. That’s why you can meet different approaches among the advertisers. Before we start any practical work for our clients, we always brief them to understand their needs. Try our approach on yourselves, if you’re interested, just contact us with your message and we’ll answer you ASAP.

The goals of the ICO projects, that we worked with

Over the past few months, we have led the promotion for various ICO projects. In this article, we’d like to tell about the last two ICOs promoted by us.

For the purpose of convenience, we’ll have to call them projects N and B. Sadly, we are not allowed to disclose their names under the terms of NDA, as well as some other partial info.

The projects N and B had their set financial goals – soft cap and hard cap. These are the minimum and the maximum amounts, which they planned to collect through ICO.

Worth noting:

- Project N collected a soft cap of $1M in a matter of minutes after the start of a pre-sale.

- Project B collected around $20M from direct institutional investors before the start of an actual token sale.

Thus, the minimum investment threshold has been reached at the very beginning.

For ICO, collecting a soft cap is a critical moment. Prior to it, there is no guarantee that the project will be fulfilled and won’t have to return deposits to its investors. With a soft cap reached, the N and B projects were able to further collect investments in the course of an ICO.

How we got prepared for running an ad campaign

At this stage, we’ve done an in-depth analysis of the geo data. ICO has no limits in geography. But we had to make sure that the attracted traffic will consist of users, who are ready to invest in our projects.

We applied geo data as a parameter to all traffic groups along the funnel. We’ll tell more about these groups in the next section of the article.

The geography has been divided horizontally and vertically. We identified regions where people are most interested in investing in ICO projects and, within these regions, the zones by the investments activity. These data were used in the distribution of our ad budget.

We also had a separate group of the regions, where the audience is loyal to our client’s brand. Thus, our segmentation has been done by the principle of combining potential profits and current relevance.

As a result, we identified:

- Geography with a large flow of ICO investments, divided into zones of activity.

- Geography with a certain loyalty to the brand, along with the willingness to invest.

Here’s the ICO advertising model, that we offer

Our key decision was to divide the traffic into three types: cold, warm and hot.

This is a fairly basic division. Before that, we had tested many other solutions, but later agreed that all ingenious is simple.

We collected the cold traffic in the maximum volume through direct lead generation. At this stage, our goal was for users to get onto the website. We separated them from the wide targeting.

After visiting the website, a user received a “warm” status. Users of the “warm” category were involved in a chain of content offers, including:

- proposal to subscribe to the Telegram channel,

- proposal to subscribe to updates and track the ICO progress.

In the ICO sphere, a large number of Telegram subscribers are considered as a separate indicator of project’s success for investors, as this channel gathers the users with a high interest for the case. It’s one of the rules in the ICO game.

Hot users were the ones who left their e-mails and signed up for the project updates on the website.

Now let’s talk about how we led users to make direct investments.

Our ad campaigns strategy

The simple interests and look-alike audiences had the highest efficiency, but it was all thanks to the detailed settings of the pixel with the tags.

For the projects N and B, we worked with the following social networks:

- Quora

The data from the project’s website had to be sent to each channel so that further segmentation and scaling would be possible. To do this, we have set up all needed pixel events with parameters in advance.

Many people think of ICO as a sort of crowdfunding. We used this idea and took our experience in promoting crowdfunding projects as a basis. Thus, we divided the optimization of ad campaigns into periods before and after receiving the info on the facts of investments from the companies.

At the start, we focused on the audience leaving the data on the project’s website. When the pixel began collecting the first users wishing to invest, we launched an initial optimization on the users who have filled out the subscription form.

Prior to the start of a direct sale, we couldn’t know, which users are ready to pay the amount. We received such information after the start of a token sale. Having received the data on the amounts and the currency of investments from the business owners, we launched the next wave of optimization.

How we managed ad creatives

All the ad creatives were being switched based on the principle of offline events promotion, but according to our division of traffic, as described above.

When we still had enough time before the token sale start, we showed all the project’s strong sides to different target groups of the cold audience. As to the warm audience, we tried to turn it hot by directing it to subscribing to the updates or, alternatively, joining the Telegram channel.

When we had just a few days left before the sale’s start, we included the creatives with a countdown.

On the day before the token sale and on the day of the start, we launched the accelerated delivery of creatives. Messages were built around the fact that token sale has already begun or is about to begin to gather the maximum attention of our audience.

The main types of creatives were static banners and video clips. Great help here was Facebook functionality for launching dynamic creatives. In other social networks, where the option was missing, we replaced the creatives manually.

The main emphasis was on the fitting text messages. There was no time to search for creative solutions, and we went through massive testing of combinations. They didn’t show any big differences from the general trends: the button “Learn more” worked better than “Register” for the cold audience, and vice versa for the warm one.

We used the video for cold traffic not only because of its efficiency but also for collecting those who viewed them and therefore learned about the project without going to the website. We tried to guide these users to the website.

To sum up, each user segment saw their own message, and we were able to control the movement of the audience through the funnel.

How we tracked the performance

We have installed the pixels with certain events on projects’ websites.

We needed the following events:

- subscription to the updates,

- buying tokens,

- depth of viewing the website per session,

- depth of viewing the blog per session,

- clicks on social network buttons on the website,

- depth of viewing the video on the website,

- chat activation,

- viewing the whitepaper,

- adding the website to the whitelist.

In addition, we took into account the frequency of event activation. People who opened the whitepaper more than once, were gathered into the list of the most active users.

During these ad campaigns, we had to work simultaneously with different analytics systems. Massive ad spends required constant data monitoring and swift changes. We needed cross-channel tracking with different attribution models. With this need in mind, we turned to Google Data Studio.

In Google Data Studio, we were able to connect altogether the data from all involved channels – Facebook, Instagram, LinkedIn, Quora, Reddit, Twitter, and Google Analytics.

This way, we saw the general picture of different audience segments — cold, warm, hot — across all channels.

What exactly did we track on the overall picture?

- Direct performance indicators, such as CR, CTR and the related ones.

- Comparison of ad groups by the number of investments made.

- How close is a segment to reaching the target events.

- The efficiency accross the channels, in a relation to the data in Google Analytics.

- Getting to all advertising goals at each stage of a sales funnel.

How we came across a unique obstacle

Running the operations of such scale via Twitter turned into an unpleasant surprise for us.

The thing is, Twitter ads restrict the promotion on the topic of finance and investment for a number of countries. With that, the lists of forbidden countries are different in Russian and English. If any of these countries accidentally slippes into your geo targeting, your ad activity gets blocked suddenly, and as we learned, with no return.

We didn’t target any of the prohibited countries on purpose, it happened because we worked at a large scale and accross channels. We contacted the support service multiple times, but they weren’t really supportive. Although, we were pushing the search for a solution in any way we could, cutting off individual countries and providing screenshots.

We learned on practice why Twitter is considered unprofitable, when we started scaling the budget within this channel. Ad campaigns remained blocked for several weeks, and the support service did not know what happened. One specialist assured that everything would be back to normal, the second one later told us we still had prohibited countried in our targeting, the third one blamed the auction losses. We got neither a solution, nor a clear suggestion what to do.

Our ad spends were extremely high, so this was a big loss to the channel. In the end, we had to abandon Twitter and move our budgets into Facebook.

Our results and indicators

Both ICO projects collected the minimum amount at the start and their planned sums by the end of the promotion.

At the end of the advertising campaigns:

- Project N raised $ 50 million,

- Project B raised more than $ 70 million.

This was the result for December 2017. Many worried, that as an enthusiasm on the ICO topic passes, it won’t be possible to get high results.

In fact, if you explain the value of the project to the audience, you can continue collecting large sums. To do this, you just have to be ready for somewhat larger investments, than half a year ago, as well as for drafting a fitting communication strategy.

Our cost per action for the cold audience was between $7 and $18 in average, and from $1 to $10 for a warm audience.

The conversion rate has reached the following values:

- Facebook – 7-9%

- LinkedIn – 16-20%

- Reddit – 4-5%

- Quora – 13-17%.

As we were scaling, these figures fell by 1-3%, while the CPA rose by just 15%.

When we talk about scaling, we mean that our starting ad spend of $5k per day has grown to $121,703 per day. In mid-December, this number a record as well.

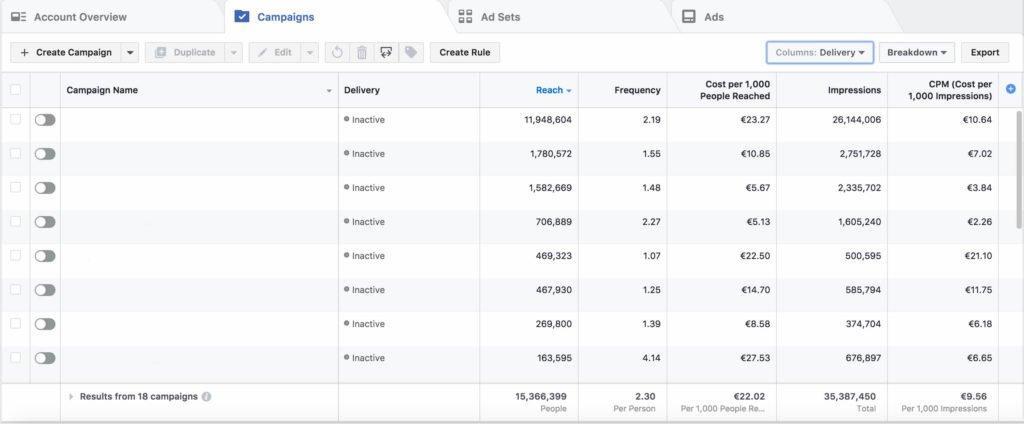

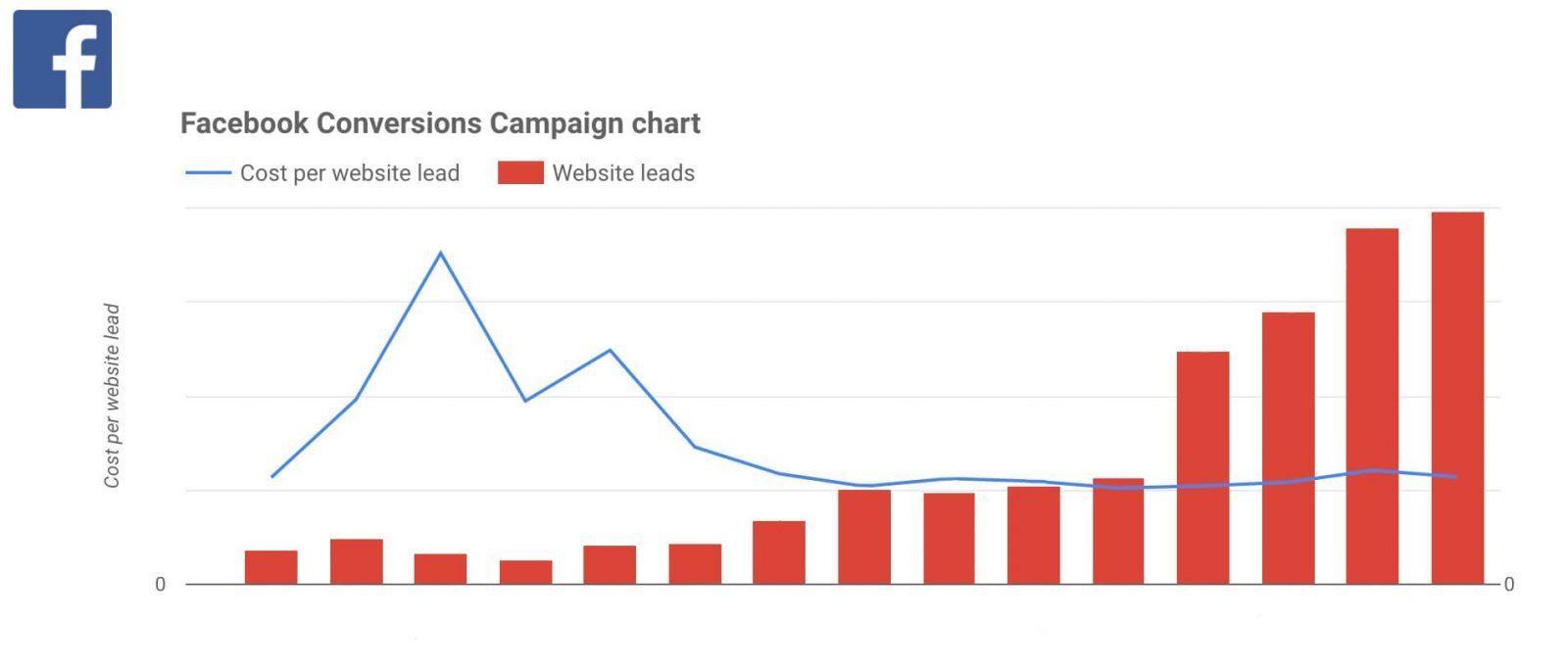

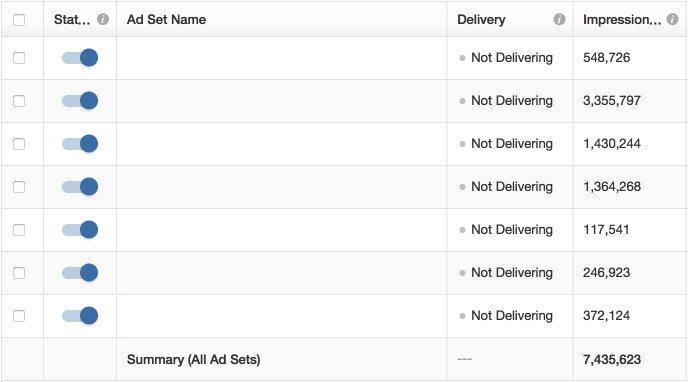

Here are our parameters on the graphs from social media ad accounts. You can check them to help you understand the dynamics in our ad campaigns.

Facebook ads

LinkedIn ads

Quora ads

Reddit ads

Why our strategy worked, and what you better not miss

- Cheap conversions cannot serve as a basis for decision-making. All users, who actually invested, didn’t cost the lowest price.

- Building end-to-end analytics is a time-consuming process, but this helps you see, which segments and target groups are actually making investments, in order to reallocate the budgets at the right time.

- ROAS is everything for us.

Were these projects difficult? Yes. Will we do it again? No doubts.

Now, that we have developed our own pattern to promote ICO projects, we are eager to use it in other projects. If you are interested in cooperation, don’t hesitate to contact us.

We hope, the article was useful to you. We’re sorry we couldn’t give you all possible info since we’re restricted by NDA. But we’ll be sure to give even more interesting cases in our coming articles!

If you have found a spelling error, please, notify us by selecting that text and pressing Ctrl+Enter.