Content

- 0.1 What is an ICO

- 0.2 More About the Projects We Worked On

- 0.3 Preparation for an Advertising Campaign

- 0.4 Our Marketing Model for ICO Projects

- 0.5 Strategy for Ad Campaigns

- 0.6 Working with Creatives

- 0.7 How Performance Tracking Worked

- 0.8

- 0.9 Key Performance Indicators We Tracked

- 0.10 Dealing With an Unexpected Challenge

- 0.11 Our Results and Metrics

- 0.12

- 1

- 2

- 3

ICO, a relatively new investment approach, has gained popularity with the expansion of the cryptocurrency market. As the number of ICO projects has surged, there has been an increasing demand for promotion. Achieving global objectives within tight time frames calls for specialized expertise to handle such tasks.

At Median ads, we always seek out challenging projects that allow us to share our practical experience. When we decided to work with ICOs, we set our sights on projects with big budgets that demanded both careful analysis beforehand and the ability to adapt quickly on the fly.

In this article, we will reveal the key aspects of the marketing model we developed for promoting ICO projects, which has brought in tens of millions of dollars in revenue for our business. Let’s go through everything step by step.

What is an ICO

The term “Initial Coin Offering” (ICO) comes from the concept of “Initial Public Offering” (IPO). In both cases, we talk about the placement of valuable assets on an exchange. For cryptocurrency projects, this is achieved through the sale of tokens.

The main difference between ICOs and IPOs is that IPOs are typically carried out by well-established companies with a solid financial foundation and a certain level of fame. ICOs, on the other hand, are used to raise start-up capital for new businesses in the rapidly-evolving cryptocurrency market.

The ICO process starts with the project announcement and the presentation of a whitepaper. This is followed by the sale of tokens, which typically happens in two stages: the preliminary stage and the main stage. This provides technology companies with the necessary investments for growth and development, while also offering investors the chance to profit from the success of the project.

Each company includes its token sale terms in the whitepaper, and the business strategy is customized based on individual needs and goals. Therefore, advertising solutions for ICOs can only be created after a thorough and substantive discussion.

More About the Projects We Worked On

Over the past few months, we’ve been promoting various ICO projects, and now we’d like to tell you more about the last two, which we’ll refer to as projects N and B for the sake of confidentiality. We can’t disclose specific data, including company names, due to NDA agreements.

Projects N and B had set financial goals, a soft cap and a hard cap, which were the minimum and maximum amounts they planned to raise from their ICO.

What’s interesting is that:

- Project N raised its soft cap of $1 million within minutes of opening its pre-sale.

- Project B raised tens of millions of dollars even before the token sale opened, directly from institutional investors.

Thus, the minimum investment threshold was reached right at the beginning. For ICOs, reaching the soft cap is a critical indicator. Until it’s reached, there’s no guarantee that the project will be carried out, and investments may need to be returned to investors. Projects N and B surpassed the minimum threshold, allowing them to continue raising funds during the actual ICO.

Preparation for an Advertising Campaign

At this point, we conducted a mandatory in-depth analysis of geodata, even though ICOs don’t have any specific location requirements for their launch. We needed to ensure we were attracting the right kind of traffic — people who were actually interested in investing in our projects.

To achieve this, we used geodata as a mandatory parameter for all of our traffic groups, which we’ll discuss more in detail later on.

For geography, we divided it up both horizontally and vertically. We identified regions where people were most interested in investing in ICO projects and then distributed our advertising budget accordingly based on the investment activity in those regions.

We also created a separate group for regions where the audience was particularly loyal to the client’s brand. This way, our segmentation was based on both profitability and relevance, ensuring that we were reaching the right audience.

As a result, we identified:

- Geographical regions with a high volume of investment turnover, divided into activity zones

- Geographical regions with brand loyalty and willingness to invest.

Our Marketing Model for ICO Projects

Our key decision was to divide the traffic into three types: cold, warm, and hot.

It’s a pretty basic division. We tested many other solutions beforehand but came to the conclusion that sometimes simple is best.

We gathered cold traffic in large volumes through direct lead generation. At this stage, our goal was to get users to the website and identify interested parties from a broad targeting pool.

After visiting the site, the audience transitioned to a “warm” status. Users in the “warm” category were engaged in a series of touchpoints, during which they were offered blog content with a subscription to updates and an invitation to subscribe to the Telegram channel.

In the ICO industry, having a large number of subscribers on Telegram is considered a separate indicator of a project’s success for investors, because users with a high level of interest gather on this channel. It’s one of the standard practices in the ICO game.

Users who provided their email and subscribed to updates on the website were considered a “hot” audience.

Now let’s talk about how we guided users towards making actual investments.

Strategy for Ad Campaigns

The most effective approach turned out to be targeting audiences with similar interests, but this was all thanks to the detailed settings of pixels and tags.

For Projects N and B we used the following social networks:

- Facebook & Instagram Ads

- Google Ads

- Reddit Ads

- Quora Ads

- LinkedIn Ads

- Twitter Ads

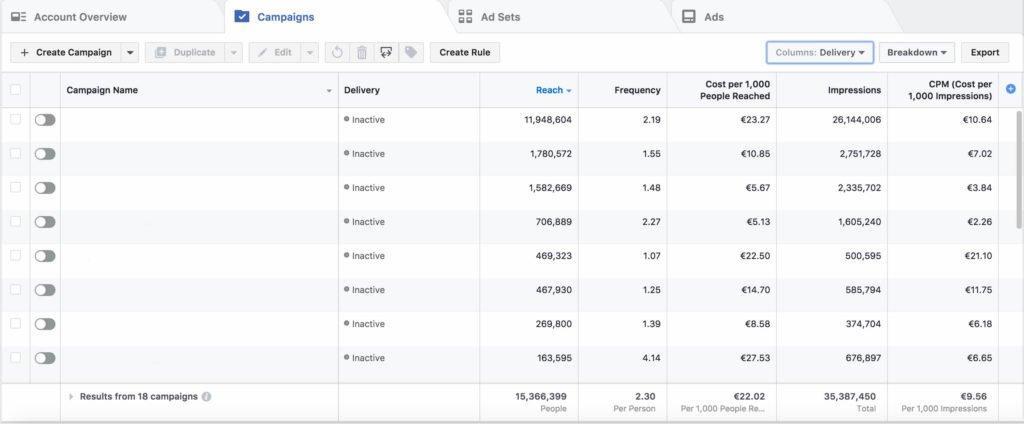

In order to enable further segmentation and scaling, we had to send data from both the project’s website and payment system to each channel that could accept event parameters. To achieve this, we first set up the event pixel and installed tags on the website.

ICO is often compared to crowdfunding, and we used our experience in promoting crowdfunding projects as the foundation for optimizing our advertising campaigns. We divided the optimization process into two periods, one before and one after we received information on investment facts.

Initially, we targeted audiences who provided their information on the project website. Once the pixel began collecting data on the first interested investors, we launched primary optimization based on the fact that they filled out a subscription form.

Before the start of the investment phase, it was uncertain which interested parties would invest and how much they would invest. This information was only obtained after the start of token sales. After receiving data on the amount and currency of investments from customers, we reconfigured the optimization accordingly.

Working with Creatives

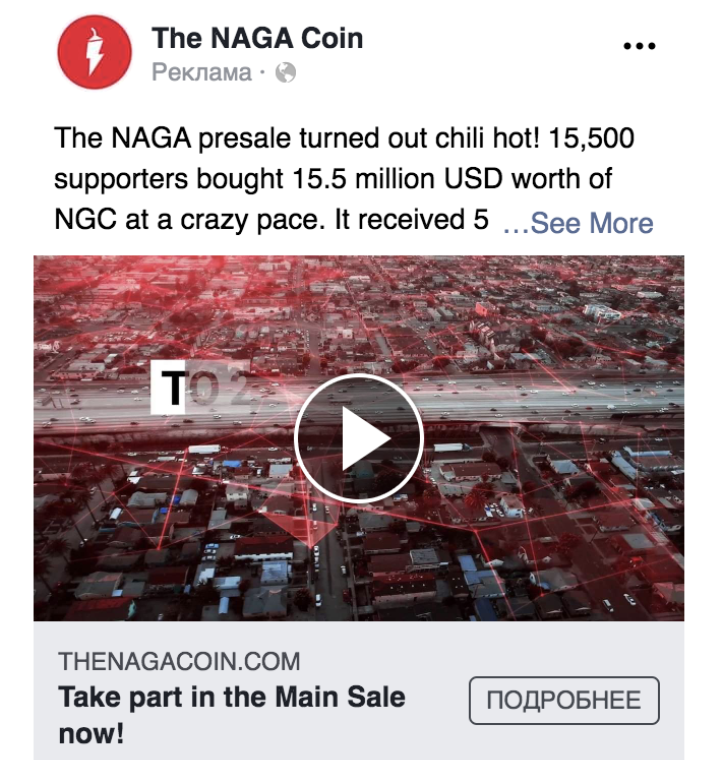

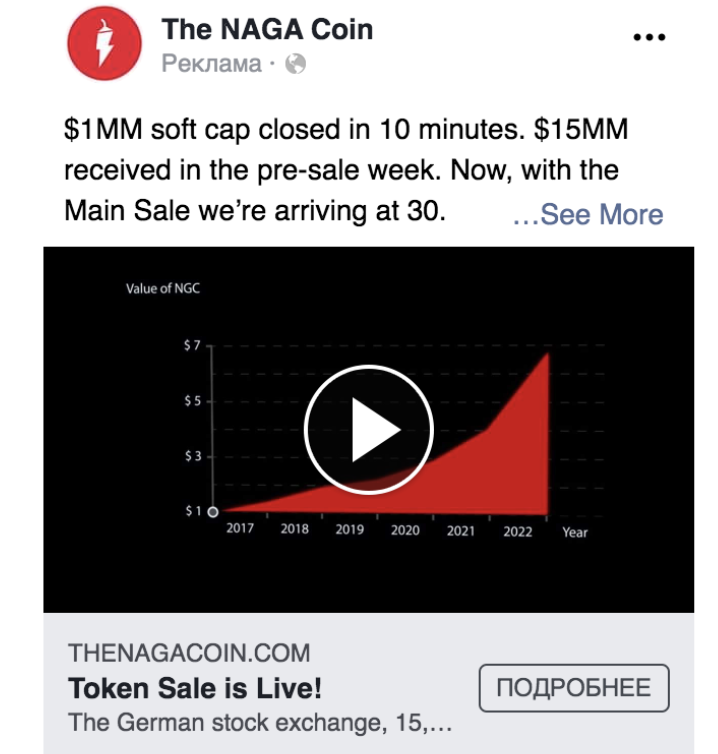

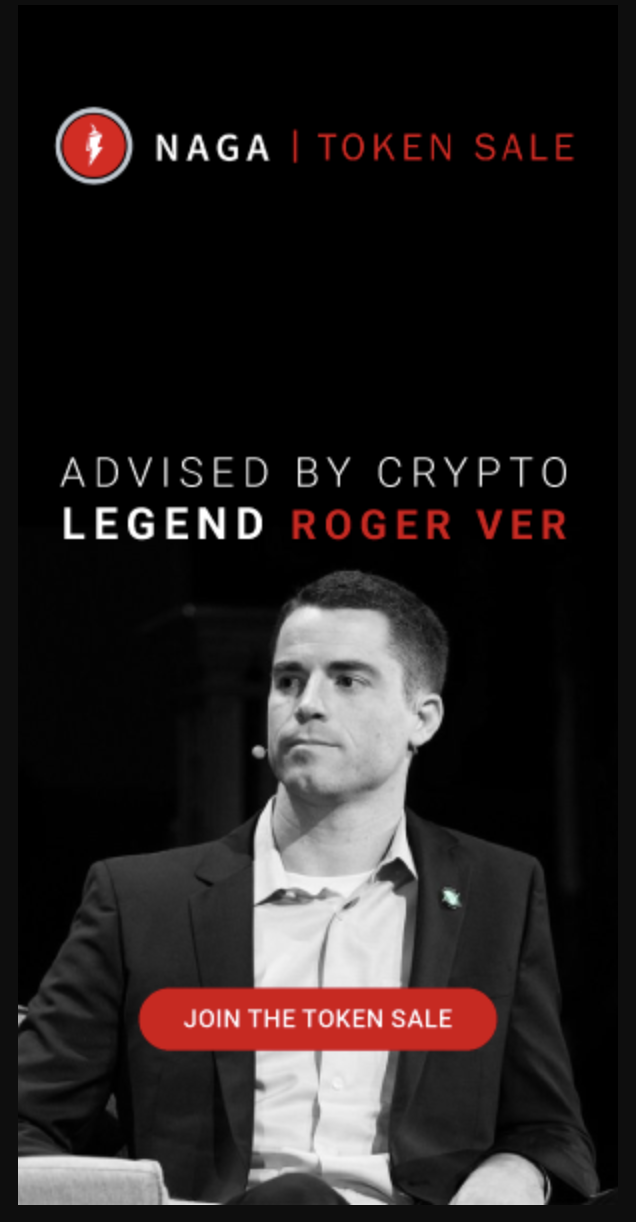

All creatives were changed based on the principle of promoting events but in accordance with our traffic segmentation, which we discussed earlier.

When there was still enough time before the token sale began, we showcased all the project’s strong points in creatives to various cold audience target groups. For warm audiences, we tried to convert them into hot leads by offering them the chance to join our Telegram channel and leave a request.

When only a few days were left before the token sale, we included creatives with countdowns.

One day before and on the day of the token sale accelerated delivery of creatives was launched. Messages were centered around the fact that the Token Sale had already started or was about to begin to grab our audience’s maximum attention.

The main types of creatives were static banners and videos. The ability to launch dynamic creatives played a significant role here. In other social networks where such an option was not available, we manually replaced the creatives.

The emphasis was mainly on the right text messages. There was no time to search for creative solutions, so we took the path of global testing of combinations. There were no significant deviations from the general trends here: the “Learn More” button worked better than “Register” for the cold audience, and vice versa for the warm audience.

We used video for cold traffic not only because it was more effective, but also to gather those who watched it and learned about the project without even visiting the site. We then guided such users to the site.

Eventually, every group of users received their personalized message, allowing us to manage the audience’s progression through the funnel.

Examples of the creatives:

How Performance Tracking Worked

To track performance, we utilized Google Tag Manager and implemented a series of events on project sites and their payment systems.

These events included:

- subscribing to news

- purchasing tokens

- depth of the site browsing per session

- depth of blog views per session

- clicks on social media buttons

- depth of video views

- chat activation

- whitepaper views

- adding to the whitelist.

Additionally, we considered the frequency of event activations, and users who opened the whitepaper multiple times were added to the list as the most active.

During advertising campaigns, we had to work with different analytics systems simultaneously. Large advertising budgets require constant data monitoring and prompt changes. We needed to track attribution models across different channels, which led us to Google Data Studio.

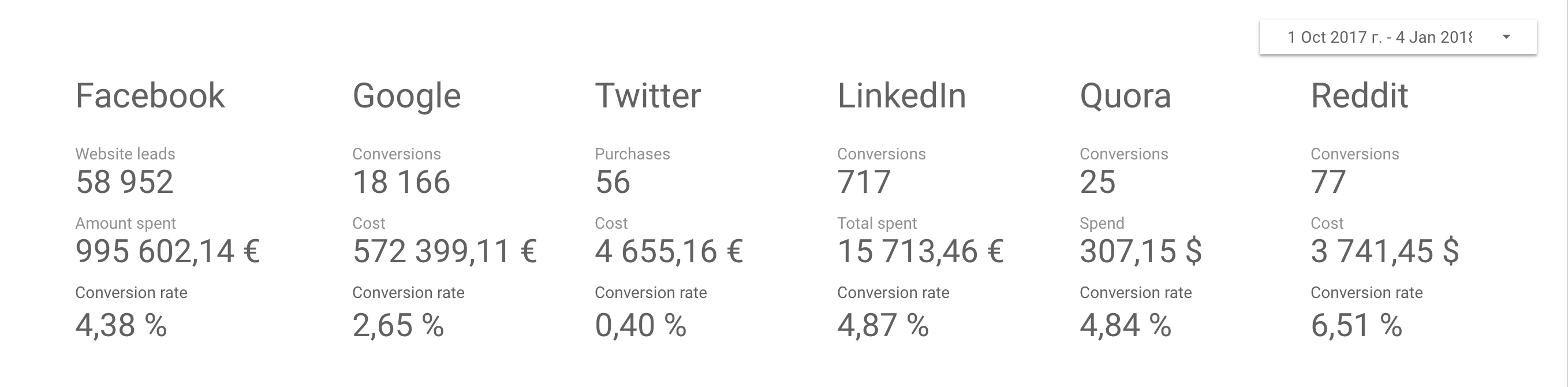

Through Google Data Studio, we could connect data from all channels used, including Facebook & Instagram Ads, Google Ads, LinkedIn Ads, Quora Ads, Reddit Ads, Twitter Ads, and compare it with Google Analytics data. This allowed us to see the big picture of working with different audience segments, including cold, warm, and hot, across all channels.

Key Performance Indicators We Tracked

- Direct performance indicators such as CR, CTR, and related metrics.

- Comparison of ad groups by the total amount of investments brought in.

- Progress of the segment towards all established objectives and events.

- Cross-channel performance and comparison with Google Analytics data.

- Achievement of all advertising goals at each stage of the funnel.

Dealing With an Unexpected Challenge

We were unpleasantly surprised while conducting such large-scale operations through Twitter Ads. It has some limitations regarding financial and investment topics in certain countries.

Unfortunately, the lists of prohibited countries were different in different language settings of the guidelines. If a prohibited country accidentally slipped into geotargeting, the ads would continue to run for a while before being permanently blocked by Twitter.

When we encountered this issue, we tried to contact Twitter support multiple times, provided screenshots, and disabled certain countries to solve it.

However, we learned through this experience why Twitter is considered unprofitable when increasing ad spend. Our ad campaigns were halted for several weeks, and even Twitter support was unaware of what was happening. Some specialists said that everything would resume as normal, while others said that a prohibited country was still present in the targeting. A third specialist blamed it on losing in the auction. Despite spending a significant budget, we were unable to receive a clear answer or solution, which was a big setback for the platform. Ultimately, we had to switch our budget to Facebook and abandon using Twitter Ads.

Our Results and Metrics

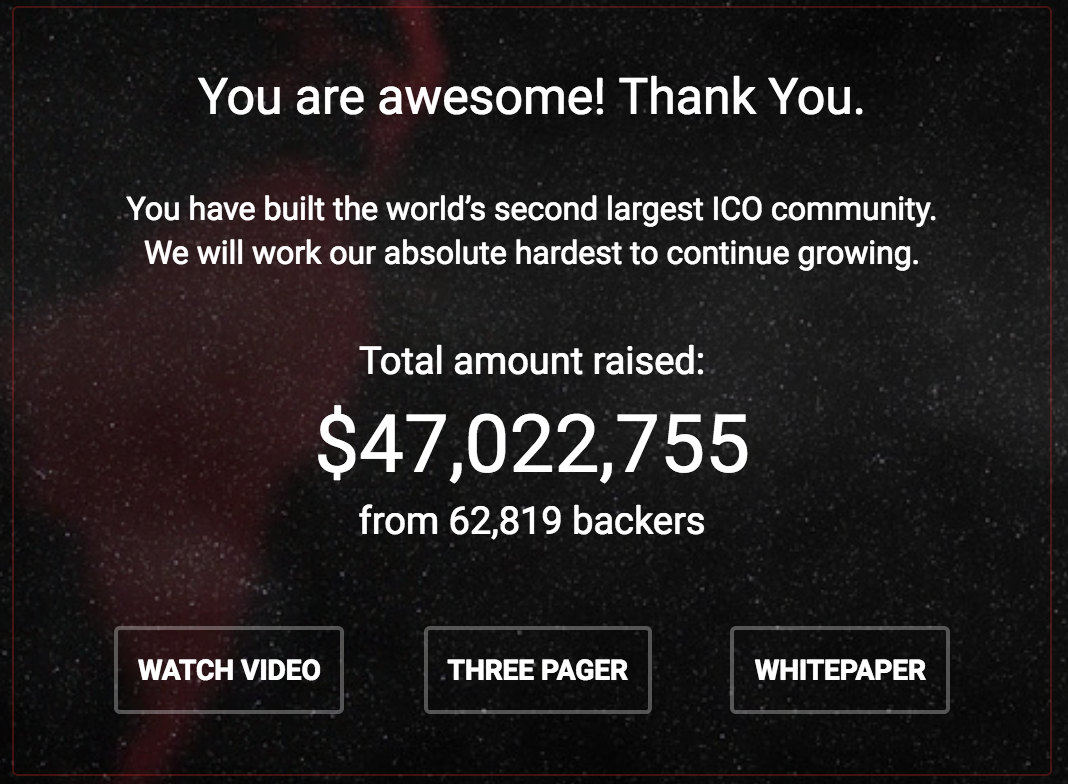

Both of our ICO projects met their minimum funding goals at the start and achieved their desired results by the end.

At the end of advertising campaigns:

- Project N raised $50 million

- Project B raised over $70 million.

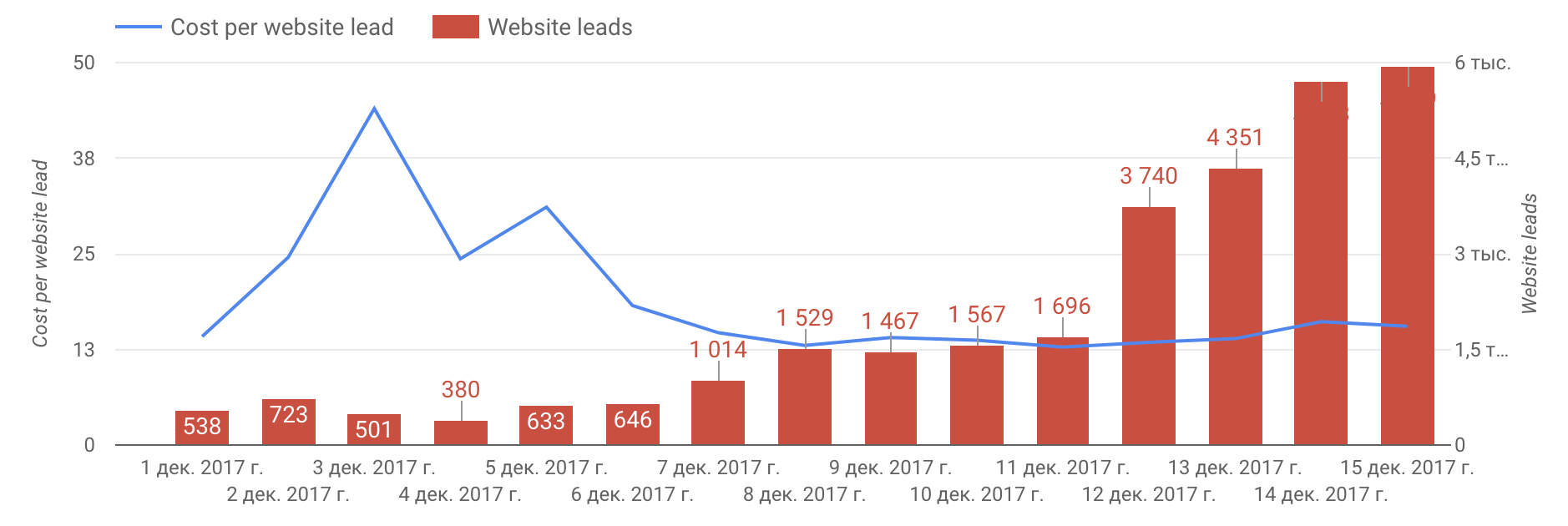

In December 2017, both of our ICO projects were able to raise the minimum amount needed to start and eventually reached their desired results. Some people were worried that after the ICO hype died down, it would be difficult to achieve similar results. However, if you can convince your audience of the value of your project, it is still possible to raise significant funds. Today, it is more expensive to grow your audience through advertising compared to six months ago.

Our cost per action (CPA), which is the price for a subscription from a new audience, ranged from $7 to $18 for a cold audience and from $1 to $10 for a warm audience.

Our conversion rates remained steady at the following values:

- Facebook — 7-9%

- LinkedIn — 4-20%

- Reddit — 4-7%

- Quora — 4-17%

When we scaled up our advertising efforts, we saw a decrease in conversion rates by 1-3%, but the cost per action only increased by 15%.

When we talk about scaling up, we mean that our initial expenses of $5,000 per day grew to $121,703 per day. This amount was a record daily high in mid-December.

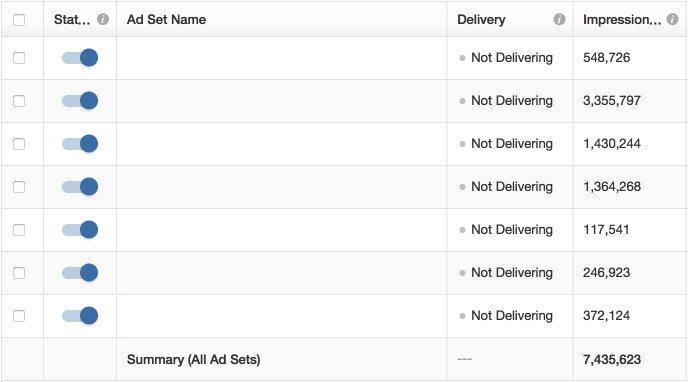

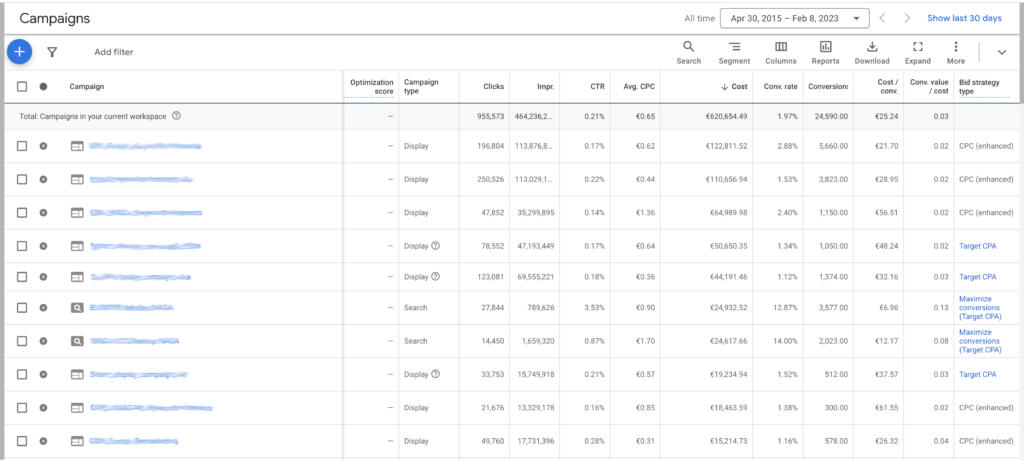

Our metrics are best represented by the graphs in our advertising accounts:

Facebook & Instagram Ads:

Google Ads

LinkedIn Ads

Quora Ads

Reddit Ads

Conclusion

Why our strategy worked and what important points should not be missed:

- Using cheap conversions as the basis for decision-making is not advisable. All users who actually made investments cost more.

- Building end-to-end analytics is a time-consuming process, but it’s crucial in order to identify the segments and target groups that are truly driving investments and to allocate the budget accordingly.

- ROAS is always a top priority.

Was this a challenging project? Absolutely. Would we take it on again? Undoubtedly.

Now that we’ve established a pattern for supporting ICO projects, we’re eager to apply it to other initiatives. If you’re interested in collaborating with us, please get in touch.

We hope you found this information useful! We apologize for not being able to provide all the numbers due to NDA restrictions. Rest assured that we’ll be sharing more successful case studies from our team in the future.

If you have found a spelling error, please, notify us by selecting that text and pressing Ctrl+Enter.