Content

Do you want to understand whether your advertising budget is spent effectively or not? How does your social media or google ads targeting options working? Then analyze your ROAS!

This metric will help you effectively manage ad budgets and find working channels to attract customers. Our article will tell you what ROAS is, how to calculate it, and use the obtained results correctly.

What is ROAS

Return On Ad Spend, as ROAS stands for, is a metric that shows the return on ad investment and is used to measure the performance of an ad campaign, set, or individual ad.

You can analyze impressions, traffic, and conversions, but these are quantitative indicators that don’t say too much about quality in terms of profitability. Paying attention only to them, you may not notice the presence of problems or come to false conclusions regarding the effectiveness of ad promotion. With the help of ROAS, you can evaluate the income from marketing methods, determine the effectiveness of each tool, and define the reasonableness of its use in the future. With proper tracking of the indicator, each advertiser has a chance to optimize ad spending to get the maximum profit with a minimum investment.

There are several metrics for analyzing business performance, however, if an entrepreneur or advertiser uses only ROAS, he will already be able to split and change advertising costs across all channels. Advertising will be perceived as an expense aimed at additional market shares without explicit restrictions on fixing the target profit rate (percentage of profit to investment). This will help control your total income or expense.

How to Calculate your Ad ROAS?

To calculate ROAS, you need to know your ad spend and total conversion value – the amount of money received from the customers who came with the help of this ad.

The formula looks like this:

ROAS = total conversion value / ad spend

Let’s say an advertiser is promoting online courses. The client wants to determine the ROAS for the last 14 days. During this period of time, $ 5,500 was spent on ad, 340 leads were received, and 115 people bought access to the course for $ 100.

Total conversion value is $ 11,500 ($ 100 × 115)

ROAS = 11,500 / 5,500 = 2.09 or 209%

Based on this, investment in advertising in two weeks paid off by 209%, and each dollar spent on advertising brought in $ 2.09.

If you’re running Facebook ads, the task becomes even easier. You can view the parameter value in the reports in the Ads Manager.

Where to Collect Data From?

Data for calculating the payback can be taken from the analytics services Facebook, Google Analytics, Yandex.Metrica, etc.

Determining the ROAS Break-even Point

A competent assessment of profitability involves finding a break-even point.

The break-even point is the sales volume at which expenses are offset by income. In other words, the moment when the investment paid off, but nothing was earned.

This parameter demonstrates the required sales volume to obtain zero profit at a predictable level of expense. How does this relate to Return On Ad Spend on Facebook, Instagram, Google ads? You may face a situation where ROAS will reach 100, 300 or even 500%, but you will not notice that behind these there is no return on investment. To prevent this from happening, it is important to determine the ROAS break-even point, for which you need a target profit rate. We have already mentioned that this value represents the percentage of profit to investment. With this indicator, you can calculate the ROAS break-even point using the formula: 1 / target profit rate. Let’s take a look at some more understandable and specific situation.

Example

Imagine a company that sells counseling services from highly qualified professionals from various business areas. On average, one consultation costs $ 300. About 70% of this amount covers the cost of consulting specialist directly, 10% is consultants commission. We do not take into account other costs in the form of taxes, rent, etc., but proceed only from the cost of servicing the proposed consultation.

70% off $ 300: $ 210 (300 × 0.70)

10% off $ 300: $ 3 (300 × 0.01)

Coming out of the sale for $ 300, the company receives $ 87 profit, the profit margin is 29%, and the ROAS break-even point is 1 / 0.29 = 3.44 (or 344%).

As a result, to generate profits, the company must receive $ 3.44 for every dollar spent on advertising. If in our situation ROAS is more than 344%, the company will earn, and if it is less, it will lose the budget.

Admit, for the correct calculation of profitability it will not be superfluous to know about such things. However, in the context of talking about investment, payback, and income, it is important to take into account another coefficient – ROI.

ROI Indicator

ROI, or Return on investment, is an indicator, that reflects the profitability or loss ratio of a particular investment, taking into account all costs and margins of goods.

This ratio helps to understand the profitability of projects, as well as to avoid mistakes that can result in monetary losses. Most often, ROI is calculated for the entire business, taking into account the costs of rent, salaries, supplies, etc., to determine its growth or loss, but it is also applicable for individual projects or advertising campaigns. In this case, it is common to speak of Return on Marketing Investment or ROMI.

The return on marketing investment (ROMI) measures the overall effectiveness of marketing decisions in order to divide subsequent investments more effectively. It represents the ratio of the revenue from marketing efforts to the corresponding costs.

ROI Formula

To calculate the Return on investment ratio, you can use the formula:

ROI = (income × margin – expenses) / expenses × 100%.

In this case, the margin is displayed as the difference between the price and the prime cost, found by the formula: (price – prime cost) / price × 100%

If the indicator is less than 100%, you are working at a loss, if it is 100%, then you are working in zero, and if it is above 100%, this indicates the effectiveness of the channel and the growth of sales.

Let’s take an example. Your Facebook advertising budget is $ 100 per month. During this time, this channel has brought you customers who bought for $ 400. You need to determine ROI in this way:

(400 – 100) / 100 × 100% = 300%.

Our advertising campaign has an ROI of 300%, and every dollar spent brings 3 extra dollars.

Difference Between Indicators

While ROI and ROAS can help determine ad performance, it’s worth to understand the difference between them. If, when calculating profitability, you take into account the company’s expenses of doing business and margins, we are talking about ROI, and if not, about ROAS, respectively. In simple words: the first coefficient helps to understand if you receive more than spent on advertising, and the second one allows you to answer the question “Have we got the profit taking into account the costs of advertising and production?”

Pros and Cons

Regarding the difference between ROI and ROAS, which we talked about at in the previous paragraph, may raise the question: which of the coefficients is better to focus on? Is ROI more reliable and can ROAS results be misleading?

Yes, indeed, if you want a more comprehensive analysis taking into account many factors, you should pay attention to the ROI / ROMI formula. However, do not underestimate ROAS, because it is also a useful tool that helps to determine the profitability or loss of advertising if there is no data on margin, for example. Moreover, you can make calculations and determine at what ROAS the campaign will reach the required indicators, and will immediately understand whether it is effective or not in the process of analyzing statistics.

How to Increase Return on Investment?

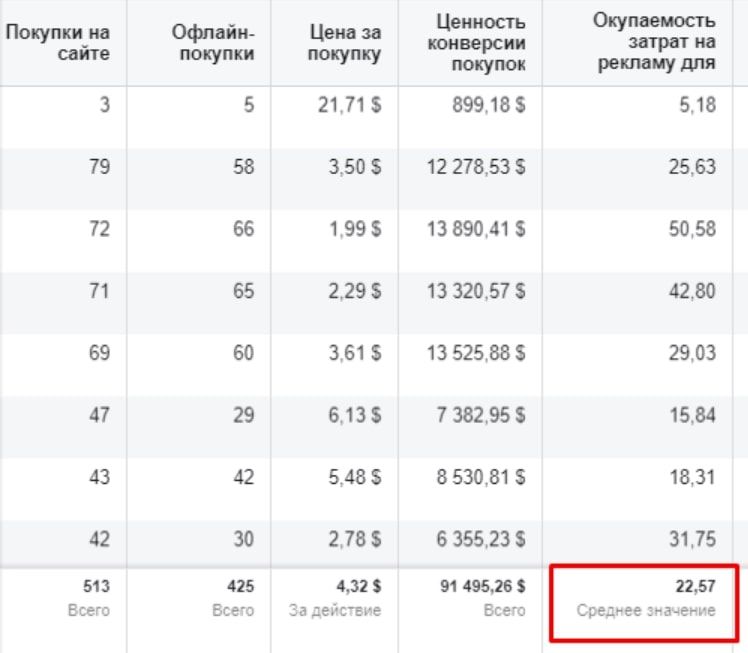

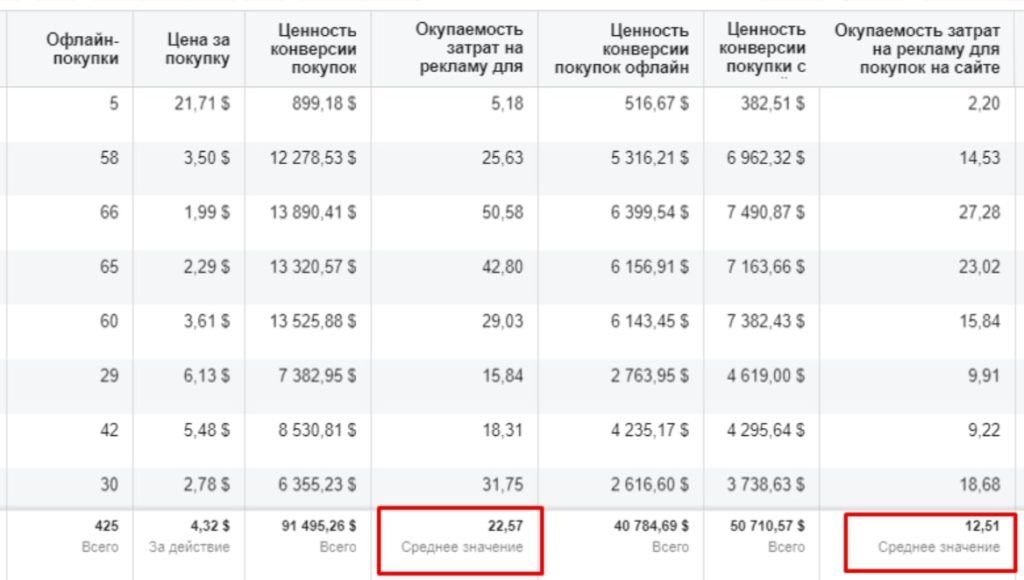

- If you have got unsatisfactory results analyzing your ROI, don’t panic right away. We recommend you check whether everything has been taken into account first. Incorrect data can distort the real picture, demonstrating the low effectiveness of a sufficiently successful campaign, so check again if you have taken into account everything. For example, if you forget about offline conversions during the analysis, you can see ROAS almost twice lower than the actual one.

- Think about how you can increase the conversion rate of your site by improving its design and user experience.

- Try to reduce your CPC. To do this, you need to reduce the cost of CPM or increase the CTR. To reduce CPM, it is important not to forget about the quality and relevance of ads, which affects the frequency of impressions and cost: the higher quality is, the lower the price and the better the results. To increase the CTR, you need to check the relevance of creatives for the selected target audience, adequately assess the demand for a product or service, and carefully determinate the target audience.

- Track conversions to identify effective ads, disable unperforming ads, and reset your budget.

- Think about reducing fixed and variable spending in production (supply) or forming services.

Conclusions

Let’s be honest, the main ad goal is to increase revenue. To do this, we develop campaigns, write unique texts, create original creatives, think over communication strategies, and set targeting. But how do you know if our actions aren’t a waste of a budget?

ROAS and ROI will be important performance indicators in this situation. The data obtained thanks to them allows us to understand which advertising channel requires an increase in investment, which ads are working in loss, which settings changes have led to positive results, etc. In order to achieve the set business goals, we should make decisions based on data analysis, and measuring the return on spend during the launch of campaigns for not to be left without profit.

A competent approach to the analysis of ROAS and ROI means wise spending of the budget and rational management of strategies, and as a result, the opportunity to increase income.

In order to receive all the valuable information about social media advertising first, subscribe to our Messenger chatbot and Telegram channel.

If you have found a spelling error, please, notify us by selecting that text and pressing Ctrl+Enter.